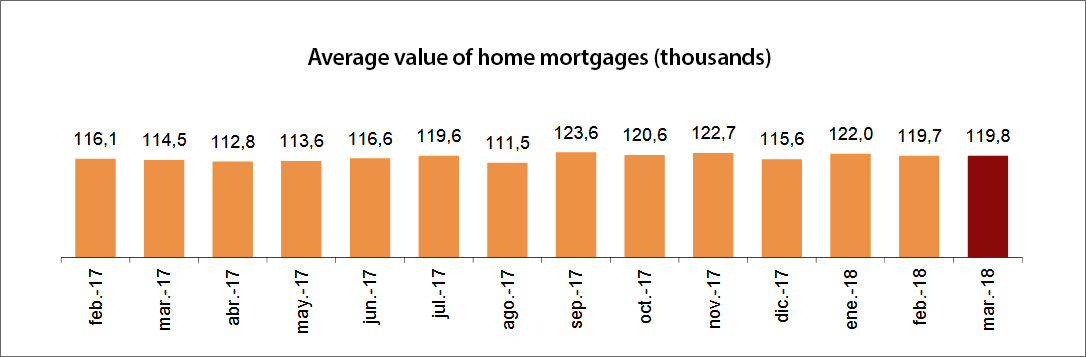

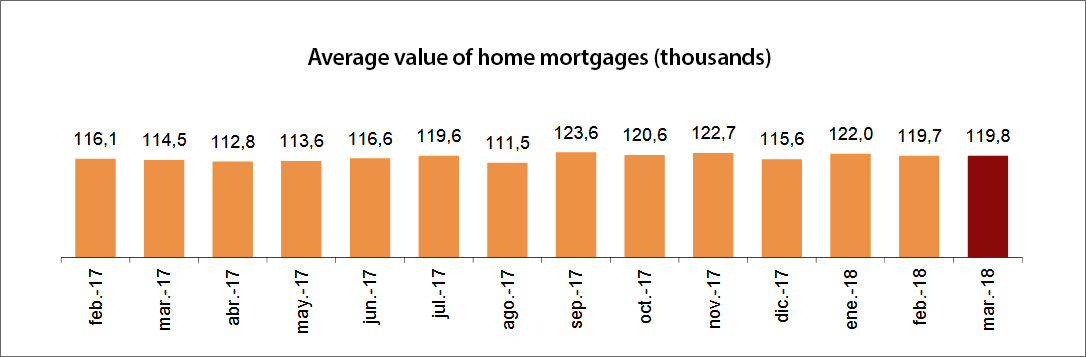

The number of new mortgages approved in March was 26,350. This represents a fall of 5.2%, when compared to the same month in the previous year. The average mortgage amount was 119,783 euros, an annual increase of 4.6%, according to the latest data from the INE.

The total value of new mortgages on urban properties reached a massive 4,771.8 million euros, 3.5% less than in March 2017. New mortgages for housing amounted to 3,156.3 million, representing an annual decrease of 0.8%.

Interest Rates

For new mortgages constituted in March, the average interest rate at the beginning was 2.65% (18.7% lower than March 2017) and the average term was 22 years. 64.2% of mortgages are at a variable interest rate and 35.8% at a fixed rate.

The average interest rate at the start of the loan term was 2.45% for variable rate mortgages (23.8% lower than in March 2017) and 3.11% for fixed rate mortgages (6.9% lower).

For mortgages on homes, the average interest rate was 2.62% (18.7% lower than March 2017) and the average term is 24 years. 62.2% of mortgages on homes are on a variable rate, while 37.8% are on a fixed rate. Fixed rate mortgages experienced a decrease of 9.9% year-on-year. Incidentally, the average interest rate for home mortgages, 2.62%, is the lowest average for over 12 months.

The average interest rate at the start of the loan is 2.42% for home mortgages on a variable-rate (with a decrease of 24.5%) and 3.05% for fixed rate mortgages (6.7% decrease).

Results by Autonomous Communities

The communities with the largest number of new mortgages approved in March were Andalusia (4,959), Madrid (4,799), and Catalonia (4,449).

The highest annual variations were seen in Aragón (27.3%), La Rioja (9.6%) and Castilla – La Mancha (8.7%).

Madrid was the community to see the most capital loaned in March with 781.4 million euros of mortgage loans approved. Following were Catalonia (626.2 million) and Andalusia (506.3 million).

The highest monthly variations were seen in Aragón (29.4%), La Rioja (12.7%) and Castilla – La Mancha (11.9%), when compared to February 2018.

The lowest monthly variations, when compared to February, were seen in Murcia (-28.3%), Basque Country (-24.6%) and Cantabria (-22.6%).