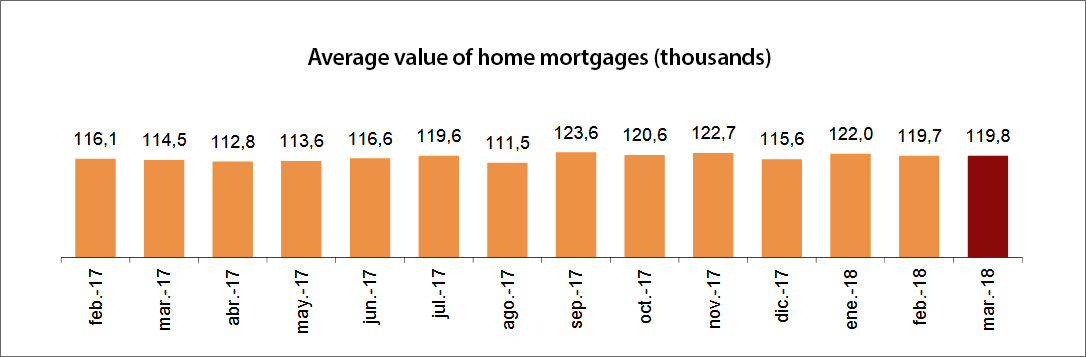

Over the last 12 months, the percentage of property buyers who needed a mortgage to purchase a home has increased form 71% in 2017, to 75% in 2018. 64% of those buyers were able to make their purchase with only a mortgage and their own savings, whereas 11% needed bank financing and family support. This Continue Reading