If you are thinking about buying property in Spain, you need to be sure you know what you are doing in order to avoid potential pitfalls.

If you are tempted by the sun or you dream of waking up to a view of the Mediterranean then you are in the right place! The Costa del Sol has one of the best climates in the world with over 300 days of sunshine every year. There are miles and miles of Mediterranean coastline, lined with golden sandy beaches and chiringuitos. We are also spoilt with some of the best food you can eat and the friendliest people. Why would you want to be anywhere else?

So, you’ve made your choice and you want to buy a house here but you know nothing of the legal process and you’ve heard the tales of woe from those unfortunates who lost money, or even their home.

Marbella For Sale have been selling property here for many years and we know the process inside out. We are experts in property sales in Spain.

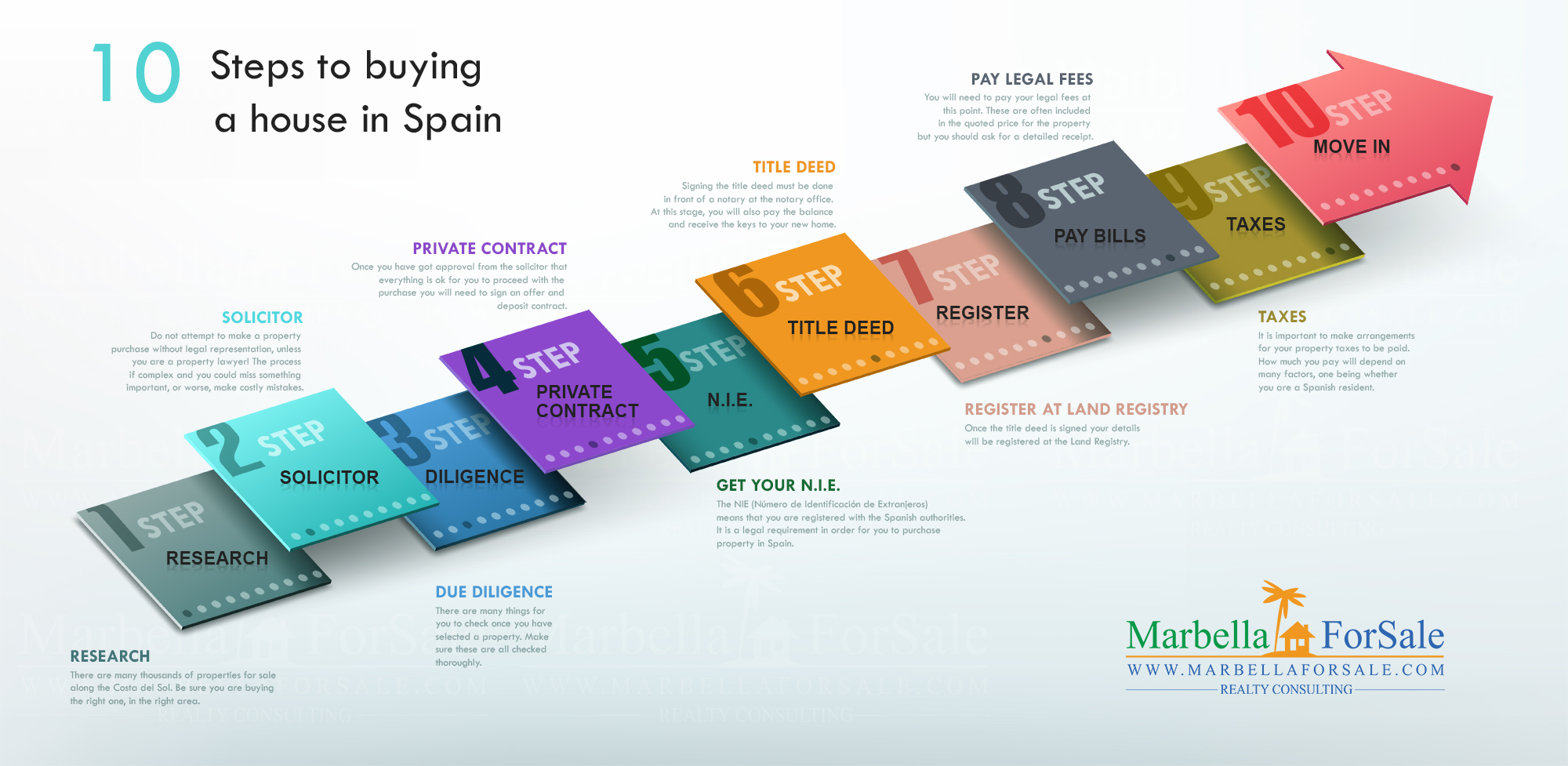

We thought it might help if we gave you a list of the 10 steps towards buying a home in Spain. This may go some way to alleviate your concerns and enlighten you as to the steps of the process. It isn’t really that scary. It can be complicated and confusing, especially if you don’t speak Spanish, but that’s where we come in. We will hold your hand throughout the entire process, attending meetings with lawyers and translating documents for you. We’ll be there to answer your questions and offer advice every step of the way.

So here are our 10 Steps To Buying Property in Spain. We hope they help!

1. Research

There are many thousands of properties for sale along the Costa del Sol. Be sure you are buying the right one, in the right area. Don’t be tempted by the views if you need to be near a school. Don’t choose a property a bit further inland if you don’t have a car.

You should also consider whether you want to buy a new property, possibly off-plan, or a resale property. Buying a new property off-plan can often mean you get a better price. However, buying a resale property can be safer as there are no surprises. The property will have a history and any problems are likely to have been resolved already.

There are many things to consider when selecting a property. Here are just a few things to consider:

- Proximity to local amenities/schools/hospitals

- Local taxes

- Proximity to public transport

- Possible noise pollution – higher in the summer months when close to tourist areas/hotels

- Beach access

- Road access

- New property or resale

This is by no means a conclusive list but it does give you an idea of things to bear in mind. Don’t forget, what you need now may be different in a few years’ time. You may not have children today but are you planning to have them soon? This is likely to be one of the biggest investments you ever make. Be sure it’s the right one!

2. Legal Advice

Do not attempt to make a property purchase without legal representation, unless you are a property lawyer! The process if complex and you could miss something important, or worse, make costly mistakes. We will advise you in the first instance before passing you to our legal representative. As mentioned previously, we will be there for you through every step. Our lawyers will:

- Understand you and your financial position

- Speak with you in your native language

- Explain the process and any associated costs

- Be available anytime to answer questions and offer advice

3. Due Diligence

Buying property can be a risky business if you don’t do your due diligence. There are many things for you to check once you have selected a property. These include:

- The legal status of the property

- Ensure that the property is free of debts and charges

- Ensure the utilities are paid up to date

- Check the usage status of the property

- Ensure there is sufficient planning permission in place if you intend to extend or modify the property

We will help with these points by requesting the relevant documents from the seller or their solicitor.

4. Private Contract

Usually, you will have to pay a reservation deposit at this point and sign an offer and deposit contract. This is to remove the property from the market and allow you or your lawyer the time to do the required checks without the risk of someone else buying it. This deposit is usually around 6,000€ and is refundable.

Once you have got approval from the solicitor that everything is ok for you to proceed with the purchase you will need to sign a private contract. Although this contract is not logged with any official registry, it is considered binding and you must be sure to read through it completely before you sign it.

At the point of signing you will be required to pay a deposit, usually 10% of the purchase price but it can be more. If you subsequently pull out of the deal you are likely to lose that deposit so be sure before you sign. If the seller pulls out after the deposit is paid then you are entitled to claim double the amount of the deposit in compensation, unless otherwise stated in the contract.

5. Obtain NIE Number

The NIE (Número de Identificación de Extranjeros) means that you are registered with the Spanish authorities. It is required for you to purchase property in Spain. Obtaining an NIE is a relatively simple process that usually requires only one visit to the Oficina de Extranjeros. We will help you complete the application and can attend with you.

6. Title Deed

Signing the title deed must be done in front of a notary at the notary office. At this stage, you will also pay the balance and receive the keys to your new home.

You will receive a copy of the document at this stage, known as the Copia Simple. If you have taken a mortgage for the property, then the bank will retain the original document until such time as the loan is cleared.

7. Land Registry

Once the title deed is signed your details will be registered at the Land Registry. At this point, the utility companies should be informed of the change of name.

8. Pay Legal Fees

You will need to pay your legal fees at this point. These are often included in the quoted price for the property but you should ask for a detailed receipt so you are aware of exactly what you are paying and what for. You should be given original invoices for the notary fees, and the taxes you have paid. Keep all these documents, invoices, and receipts.

9. Taxes

It is important to make arrangements for your property taxes to be paid. How much you pay will depend on many factors, one being whether you are a Spanish resident. Both residents and non-residents are liable for IBI (council tax). However, non-residents must also pay imputed income tax in Spain. This is usually 2% of the cadastral value of the property. If you intend to rent out your property you will also be liable for Impuesto de la renta de no residentes. This is a tax based on the income you receive from the rental of the property.

10. Move in!

If you followed our advice, made all your checks, and then checked again, you will now be able to enjoy your new home on the Costa del Sol. Congratulations!

If you need any further advice or have any questions, our multi-lingual team are standing by to help. You can call us on +34 952 907 386 or email us at info@marbellaforsale.com, and we’ll go out of our way to help you with your purchase.